Good practice

Using a Systemic Approach to Analyse the BioTrade Market System

There are concerns about an overemphasis on economic growth in systemic approaches to programme design and management (also known as market systems development – MSD), which many people feel pays insufficient attention to, or even willfully ignores the environment. There is a grain of truth in this critique – the approach does not inherently include an environmental perspective. As with gender equality, a systemic approach can only contribute to positive environmental outcomes if we actively integrate it into our thinking from the start.

Andrew Wilson, Robbie Hogervorst & Zenebe Uraguchi from HELVETAS Swiss Intercooperation present the case of Ethical BioTrade as an example that the systemic approach can create sustainable, positive environmental impacts, and contribute to the preservation of vulnerable or endangered species.

BioTrade in Context

Ethical BioTrade is defined as activities of collection, production, transformation, and commercialization of goods and services derived from native biodiversity under the criteria of environmental, social and economic sustainability. The key to the BioTrade business model is that sustainable use of native plants, animals and micro-organisms benefits communities using these resources, ensuring that they protect and maintain populations of species that might otherwise become endangered or extinct.

The generic BioTrade business model makes sense for companies, producers and collectors dealing with products derived from native biodiversity, but functioning BioTrade value chains can only exist and grow under specific circumstances. Collection of wild products needs to be managed to avoid over-harvesting, certification services are needed, export promotion is required to introduce exotic new products to high-end markets and there are many other pre-conditions specific to different products, species or markets. Behind BioTrade’s deceptively simple façade lie complex relationships among actors (e.g. service providers, local authorities) whose capacities and incentives we need to understand, and a range of problems with service delivery and rules which we need to identify the root cause of, not just superficial symptoms.

In the past, different approaches have been used to analyse and design BioTrade interventions, including value chain analysis and export potential analysis. While both of these approaches are highly useful analytical tools, as the following examples show, they both leave very important questions unanswered.

Example 1: Export Potential Analysis

- A client wanted to use the Export Potential Assessment methodology of ITC to identify high-potential BioTrade ingredients, although ITC itself calls for additional research into product/sector/export strategies and policies to supplement outcomes of this statistical exercise.

- In essence, this tool uses past trade data of exporting countries and compares this information to other suppliers/markets to estimate the export potential of products.

- This is a powerful tool to quickly identify products which have a potential for increased exports and to provide a ranking among them.

- However, the tool depends on trade data being available at the product level, which is difficult for Biotrade products, which are spread out over various Harmonized Commodity Description (HS) codes or don’t have specific HS codes. Sustainably produced products are also not identifiable within the trade data.

- The effort identified product groups which include Biotrade ingredients, such as vegetable oils, dried fruits or spices which had the highest potential for specific countries and markets.

- The project decided that additional quantitative and qualitative data was needed in terms of strengths and weaknesses within selected value chains and the business enabling environment. Also, desk and field research was included at the product level, to specify products within the product groups identified by the ITC methodology looking at economic, social, technical and environmental criteria. However, even this additional research was inadequate to uncover cross-cutting issues, and did not relate supply chain weaknesses to dysfunctions in supporting market systems.

Conclusion: The EPA approach is a useful way to quickly narrow down the most promising product groups in a BioTrade project, but additional research is clearly needed. A systemic approach would have linked bottlenecks in the selected supply chain to their root causes, even if these originate in other market systems. Moreover, a systemic approach could have better integrated cross-cutting issues which can affect export potential, as well as the impact of interventions, but which are not included in a trade-focused analysis tool as the EPA approach.

Example 2: Value Chain Analysis

- A client wanted an export development program with intervention options based on different modules (export coaching for companies, market analysis, sector strategy development, sector/industry organization development, human resource development).

- Value chain analysis was chosen to understand the natural ingredients sector. The VCA needed to look at several cross-cutting issues: water/drought, gender, and environment

- The VCA focused on the entire value chain, from raw material base to regional markets and the market in Europe with desk and field research at all levels.

- Strengths and weaknesses were identified at each level of the value chain. Some were related to structural issues within the value chain (e.g. business skills, trust, understanding of markets) others were outside the core value chain (access to land, access to water, access to finance) or even outside of the country (border logistics).

- In terms of the environment, the analysis identified legal issues around biodiversity access and sustainable use, especially in protected areas of the country, including a lack of capacities and systems for sustainable use of wild resources (permitting, resource assessment, and management)

- However, although issues were identified linked to the value chain (both in terms of service delivery (e.g. finance or business consultancy services for wild-collection / traditional knowledge-based business) and enabling environment (systems, enforcement of legislation for access to resources) further research was needed to develop interventions in these areas because the motivations of key stakeholders responsible for such functions and transactional relations were not known.

Conclusion: A systemic approach to analysis would have provided the information needed to design interventions that effectively dealt with the identified issues, and may also have uncovered some additional “root cause” issues that were not anticipated in the original request from the donor. Furthermore, a systems approach would have extended the analysis beyond identifying which stakeholders are responsible to identify players with the right motivation to instigate change.

In both of these examples, the analytical tools used provided useful information, but left key questions unanswered. As a result, projects using only these tools had an incomplete understanding of issues and opportunities, requiring additional efforts in the project design phase. These projects also ran the risk of designing interventions that would not achieve the environmental and economic potential of Ethical BioTrade, or do so without ensuring their impact was sustainable beyond the project’s time horizon.

From the perspective of a systemic approach, export potential assessment is a good tool to identify sectors, but as a statistical tool it does not aim to answer the question “what should we do?”. In most BioTrade projects, this type of statistical analysis and investigation is followed-up using value chain analysis for selected products and species. As discussed in the second example, value chain analysis provides a great deal of additional information which is important for decision making but not sufficient to design effective interventions for the “cross-cutting issues” or in identifying the motivation of the actors involved.

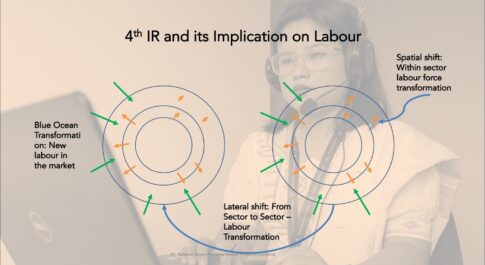

What Do We Achieve with a Systemic Approach?

The systemic approach provides a structure which guides us through the analytical process, giving us a holistic view of a complex topic. This conceptual framework allows us to use familiar tools like export potential analysis to identify appropriate sectors/products or to use value chain analysis to understand core market systems.

Systemic analysis adds real value by extending our focus and paying sufficient attention to so-called “cross-cutting issues” that have not always been analyzed with the rigour they require. It does this through intensive analysis of interconnected systems (e.g. training, advocacy, infrastructure), giving projects the opportunity to delve deeply into the environmental, social and equity issues that are very often the root causes of the problems our projects are intended to resolve. Often, root causes reside not in the demand-supply transactions but in interconnected functions, for example in the underperformance or failure of training or coordination between private enterprises and public agencies.

By treating these issues as root causes, systemic analysis forces us to properly define and seriously analyze the environmental and social issues we care about, allowing us to design effective interventions around them. In short, applying a systemic approach to analysis can make a major contribution to achieving the positive environmental, social and economic aspects of Ethical BioTrade.

Andrew Wilson studied rural development, business administration and law. Andrew worked as a lobbyist for the food sector in Canada, before starting his career in development with HELVETAS in Laos. Andrew has worked with the MSD approach in Eastern Europe (as Project Director of MarketMakers), the South Caucasus and South-East Asia and is keen to apply systemic thinking in a practical, common-sense way.

Robbie Hogervorst is a Senior Consultant in ProFound. He has twelve years of experience in value chain development and trade promotion for natural ingredients. During this period, he has developed a strong network and expert knowledge in the market in Europe. He also developed skills to develop value chains at the company and sector level with the private and public sector. At ProFound, he he develops new concepts to build sustainable value chains of natural ingredients, such as the Africa Pavilion at BioFach. He also designs effective interventions for ProFound’s clients with the purpose to strengthen biodiversity, improve incomes for producers and link small businesses to European buyers. He also manages ProFound’s sector development and company coaching activities in South Africa.

Zenebe Uraguchi is a development economist with multi-country experience working for a multinational private company, an international development bank and a research institute. He currently works with HELVETAS Swiss Intercooperation, based in Switzerland, as Programme Coordinator for Eastern Europe and Senior Advisor in market systems development.

You may want to read